You’ve built success with intention.

Now bring the same certainty to your wealth.

At Think Capital, we partner with accomplished professionals, business owners and families who want their finances to reflect the same discipline, intelligence, and foresight that built their success.

Our role is to help you structure wealth that supports the life you’ve built - and the legacy you intend to create.

Our clients value expertise, precision, and perspective.

They want more than investment performance they want purpose, structure, and peace of mind.

Australian Professionals, Business Owners and Families

The Challenge

You’ve built success through hard work and good judgment.

You’re earning well, managing a mortgage or investment property, contributing to super - but you know your money could be working harder for you.

You’ve done the right things, but the structure underneath hasn’t kept pace with where you are now.

You’re juggling tax, super, investments, insurance, and debt - and while it all functions, it doesn’t feel optimised.

You might recognise yourself here:

-

You’re paying more tax than seems reasonable for your effort and discipline.

-

You’re unsure whether your super or investments are aligned with your goals.

-

You have multiple accounts, policies, and products - but no cohesive strategy.

-

You want to build wealth efficiently, without unnecessary risk.

-

You want confidence that your financial decisions are working together - not against each other.

What You’re Feeling

-

Frustrated - you’ve done everything right, but it still feels fragmented.

-

Cautious - you want to grow wealth intelligently, not chase trends.

-

Curious - you know there must be better ways to structure things, you just haven’t had time to explore them.

-

Ready - to move from reactive to strategic, from earning well to building wealth deliberately.

What You Really Want

-

Structure – a clear, integrated plan that brings your finances together.

-

Efficiency – to reduce tax leakage and get more from what you already earn.

-

Confidence – knowing your investments, super, and insurances are working cohesively.

-

Progress – measurable financial improvement and control.

-

Independence – the ability to make life choices based on preference, not pressure.

How We Help

At Think Capital, we help high-performing Australians simplify complexity and create financial efficiency.

We work with professionals, executives, and business owners who value prudent advice and practical results.

We help you:

-

Refine your structure so your wealth compounds efficiently.

-

Implement tax and investment strategies that align with your goals.

-

Review and strengthen your protection framework (insurance, super, estate).

-

Create a long-term plan that balances growth, safety, and control.

-

Build certainty around your future - so you always know where you stand and what comes next.

You’ve built success.

Now it’s time to make it work for you.

Women and Wealth

The Challenge

You’ve worked hard, built a career, raised a family - maybe both.

But despite everything you’ve achieved, your finances feel scattered.

Many women we meet are addressing a turning point - separation, career transition, empty nest, or simply the realisation that it’s time to take control.

You're smart and capable, but when it comes to your money, you often tell us:

“I know I should be doing more… I just don’t know where to start.”

You might relate to one or more of these:

-

You’re earning well but your savings don’t reflect it.

-

You’re unsure how to invest or whether your super is working as hard as you are.

-

You feel like you’re paying too much tax and missing opportunities others seem to use.

-

You have insurance through super but no idea what you’re actually covered for.

-

You own property but not much else, and you’re unsure if that’s enough.

-

You worry about what would happen if something went wrong - illness, job change, or loss of a partner.

What You’re Feeling

-

Overwhelmed by complexity - too many moving parts, not enough time to connect them.

-

Uncertain whether your current choices are right for your stage of life.

-

Frustrated because you’ve done the hard work but still feel financially behind.

-

Anxious about retirement - what will your future look like if nothing changes?

-

Tired of shouldering it all alone.

What You Really Want

-

Certainty – to finally see how everything fits together.

-

Control – to feel secure and confident in every financial decision.

-

Efficiency – a plan that makes your money work smarter, not harder.

-

Confidence – to build and protect wealth on your own terms.

-

Independence – to create choices for yourself and those you love.

How We Help

At Think Capital, we bring structure, simplicity, and strategy to your financial world.

We help you:

-

Simplify your money systems so cashflow, savings, and debt are working together.

-

Align your super, investments, and insurance to match your goals.

-

Reduce unnecessary tax and improve financial efficiency.

-

Build a clear plan for your future - one that evolves as you do.

-

Create a foundation of independence, protection, and confidence.

You’ve built a life through resilience and good judgment.

Now it’s time for your finances to reflect that strength.

Let’s make your next chapter your most confident one yet.

South African Expats

The Challenge

You’ve built a new life in Australia - but your finances still straddle two worlds.

Currencies, systems, and obligations that don’t align easily.

In South Africa, you had structure - businesses, investments, retirement annuities, insurance, and familiar systems.

In Australia, it is starting over - new rules, new tax, new super, new everything.

For many South Africans, the challenge isn’t a lack of discipline - it’s the frustration of not knowing how to make this new system work as well as the old one did.

Common situations include:

-

You’ve accumulated savings but aren’t sure how to structure them efficiently in Australia.

-

You’ve bought property to feel secure but feel uncertain about your broader wealth plan.

-

You’re earning well but paying more tax than expected.

-

Your super feels inadequate or disconnected, and you’re unsure how to build it meaningfully.

-

You have insurance in Australia in Superannuation, but you are unsure if it is the same as the cover you had in South Africa

-

You’ve done well financially before - but don’t yet feel “settled” or secure in Australia.

What You’re Feeling

-

Frustrated - you’re disciplined and responsible, yet progress feels slow.

-

Confused - the Australian system is complex and inconsistent compared to what you knew.

-

Disoriented - you’ve lost the familiar structures that once gave confidence.

-

Cautious - you don’t want to make mistakes or lose what you’ve already built.

-

Motivated - you just want someone to show you how to rebuild intelligently and efficiently.

What You Really Want

-

Certainty about how to structure your finances in Australia - properly.

-

Efficiency - to reduce unnecessary tax and stop money being wasted through inefficiencies.

-

Strategy - a clear plan for investments, super, and insurance that fits the Australian framework.

-

Confidence - that your family’s financial future is secure in Australia.

-

Progress - to see tangible results and rebuild wealth in a country where the numbers finally make sense.

How We Help

At Think Capital, we specialise in guiding South African professionals and families through the transition of rebuilding wealth in Australia.

We help you:

-

Align your tax, superannuation, and insurance structures to Australian law.

-

Optimise your cashflow and debt so your money works harder.

-

Create a long-term investment plan that reflects your goals, time horizon, and tolerance for risk.

-

Review and restructure insurance cover in Australia to ensure protection aligns with your residency and tax position.

-

Simplify the entire process so you can focus on life, not paperwork.

You’ve started over.

Now it’s time to build it to last.

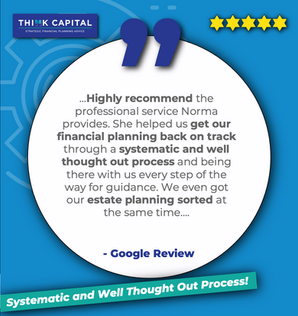

Your Stories. Your Success

Our client achievements are at the heart of what we do.

Every client journey is unique - yet the results are consistent...

certainty, confidence, and control.

Our clients tell us that Think Capital has brought order to complexity, structure to chaos, and overwhelm to calm decision-making.

From rebuilding financial independence after a major life change, to retiring early, securing family legacies, to restructuring wealth, their outcomes reflect what happens when smart people partner with disciplined advice.

Because your story deserves more than financial success - it deserves significance.